The fifth edition of the FIDI Professional Cooperation Guidelines has been effective since being ratified at the FIDI Conference in May 2024. FIDI’s Business Intelligence Manager, Marie-Pascale Frix, introduces the updated recommendations

The 2024 Edition of the FIDI Professional Cooperation Guidelines (the PCG) was approved by the Delegates Meeting in Edinburgh in May, replacing the 2020 version with immediate effect.

Existing chapters have been revised and new ones introduced to help the FIDI community operate in a clear and process-driven way.

Key changes you will find in the new document include:

- Packing list guidelines

- Procedures for abandoned cargo

- Video surveys

- Communication timelines for unforeseen charges

- Deviation of delivery

- Validity period and new clear timelines when disputing an invoice

The PCGs are a powerful tool to better manage expectations between business partners and mitigate the risk of disagreements pertaining to an international move later on.

In FIDI Focus 313, we focused on the issue of dealing with abandoned cargo, a new addition to the PCGs.

Now let’s look at another important topic: overdue invoices.

Avoiding overdue payments

Here, we are highlighting another new section. Over the past few years, FIDI has become aware – mainly through FASI and FIDI Dispute Resolution Service (FIDI DRS) – of company conduct that unfortunately is detrimental to companies’ cash flow management: specifically, invoices that remain overdue and are only contested after a long period of time.

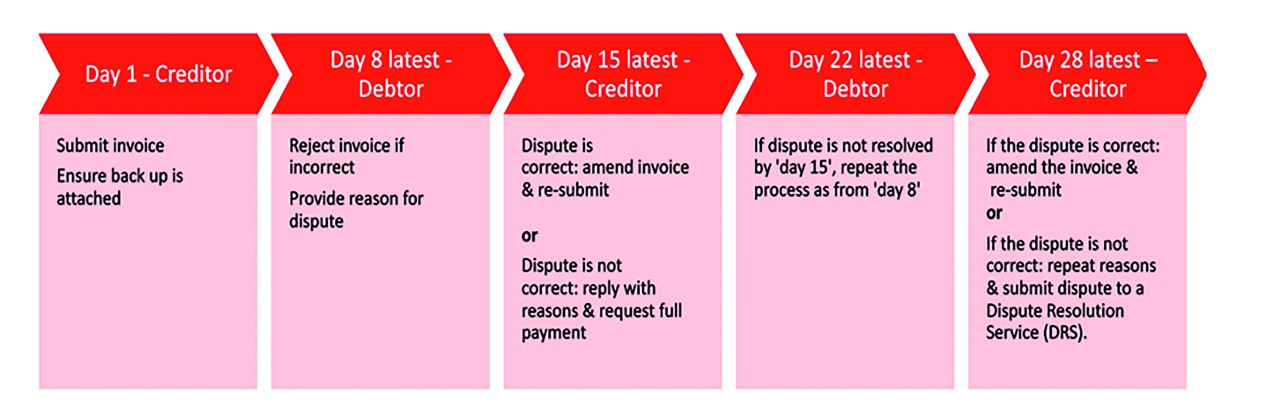

‘The PCG Committee decided to tackle this problem with the addition of a new section in the 2024 PCG Guidelines, entitled “Disputing an invoice”’, says Nick Kerr, former PCG Committee Chair and Senior Editor of the PCGs. ‘It sets out best practice for disputing an invoice, the related timeline and the resolution process, unless agreed differently by the parties at contractual stage and in writing.’

Here is the best practice in a nutshell:

- Movers are encouraged to submit and resolve disputed invoices latest within 28 days of the invoice receipt date, regardless of the payment terms

- If no agreement is reached at the end of the recommended process, the parties in dispute are encouraged to activate their trade association’s dispute resolution process (FIDI DRS for FIDI Affiliates).

While this process demands a disciplined process at both the creditor and debtor’s side, it is ultimately beneficial to both parties. Where invoices are not contested in a timely fashion, the invoice might be due in full.

For more detailed information on this process, see the 2024 PCG, section H.4, Disputing an invoice.

Please contact Marie-Pascale Frix for any comments or questions: Marie-Pascale.Frix@fidi.org